Bunny achieves Avalara AvaTax certification

“Nothing is certain except death and taxes”, said Benjamin Franklin who could not have predicted the Internet and how it has transformed our world. The global SaaS market is projected to be $700 billion by 2030 and governments want their fair share, which means that SaaS companies need to take taxation seriously.

Bunny is a certified Avalara AvaTax partner and seamlessly incorporates taxation into its quoting and billing processes. Setup takes just a few minutes. Combining CPQ, billing and taxation for subscription businesses has never been easier.

Who is Avalara?

Avalara is a company that provides tax compliance automation software for businesses. They offer a service that helps businesses accurately calculate and file their sales tax, VAT, GST, and other transaction-based taxes. They have received numerous accolades and awards, and have been recognized as one of the fastest-growing software companies in the United States.

Why should SaaS Companies worry about sales tax?

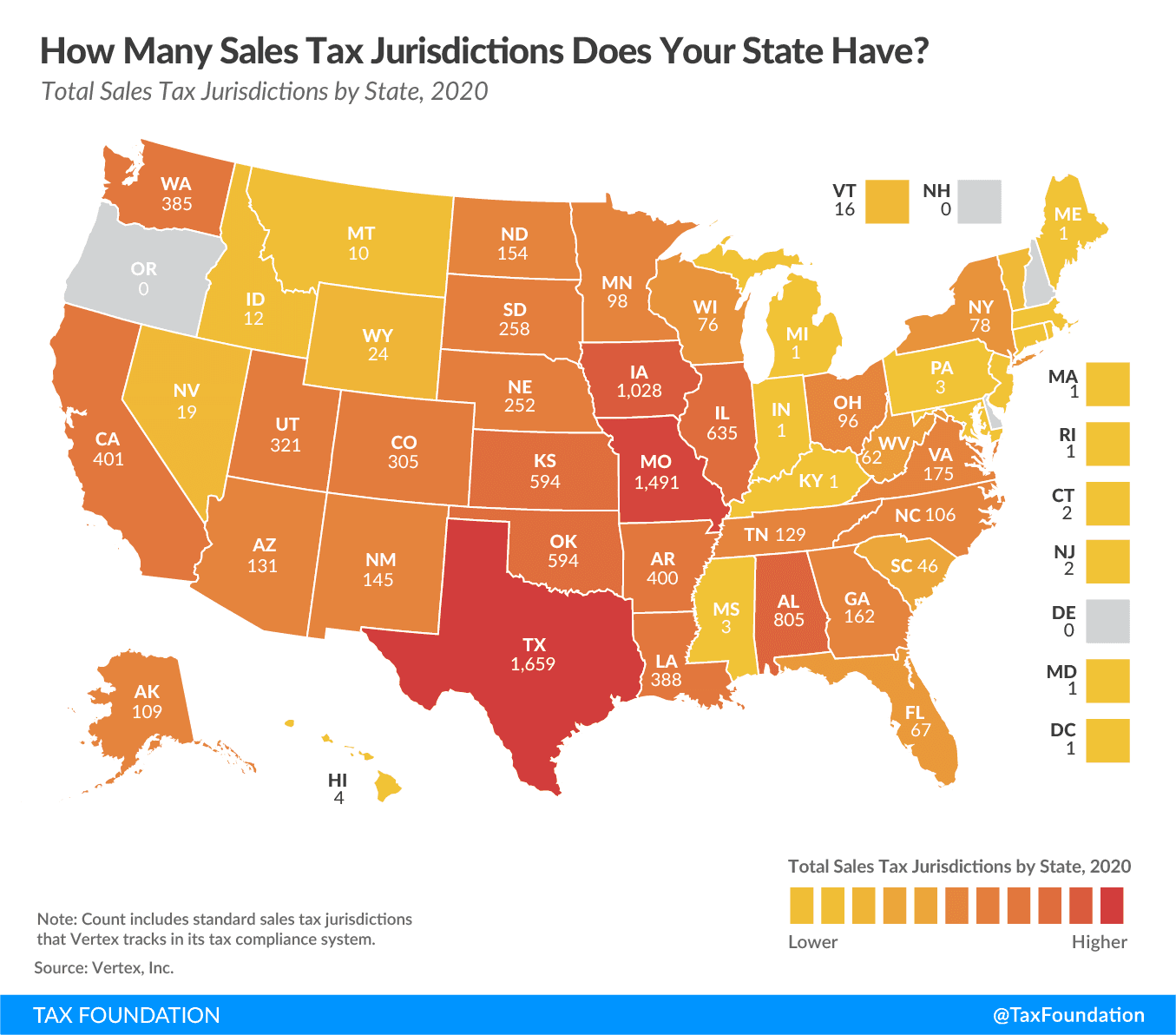

The United States tax code is extremely complex. There are roughly 11,000 different authorities that impose sales tax in the U.S. and it is virtually impossible for any business to accurately handle this challenge themselves. Taxation software to the rescue.

For a long period of time, many states and countries did not impose tax on SaaS. However, SaaS is now the way software is delivered and is a significant part of our economy, which is why more and more states impose tax on it.

The sales tax for a particular line item depends on various factors, such as the service or goods being sold, the seller’s location and the buyer’s location. Even the actual day of the year can make a difference. Tax codes can change and some states and municipalities have seasonal tax. Additionally, each line item can have up to four or five different tariffs for federal, state, municipal, city and local taxes.

In some states, a company’s SaaS sales are not taxed if their annual sales are below $100,000 or a certain number of transactions, but this can change any time.

The Streamlined Sales Tax Project was started in 2000 to simplify and modernize sales and use tax collection and administration in the United States. It arose in response to efforts by Congress to permanently prohibit states from collecting sales tax on online commerce. This program will actually save businesses money by allowing them to file returns for free in 24 different states.

In summary, there are several reasons why you should consider automating your sales tax.

Participate in the Streamlined Sales Tax program

Automate tax calculation and return – so you can focus on growing your main business

Stay tax compliant - avoid tax sanctions

Improve tax accuracy - avoid errors and improve your customer experience

Bunny's integration with Avalara AvaTax enables customer address validation and automatically adds sales tax to both quotes and invoices to ensure that SaaS companies are in compliance with current tax laws.

This is just one more way Bunny simplifies revenue operations for SaaS companies.