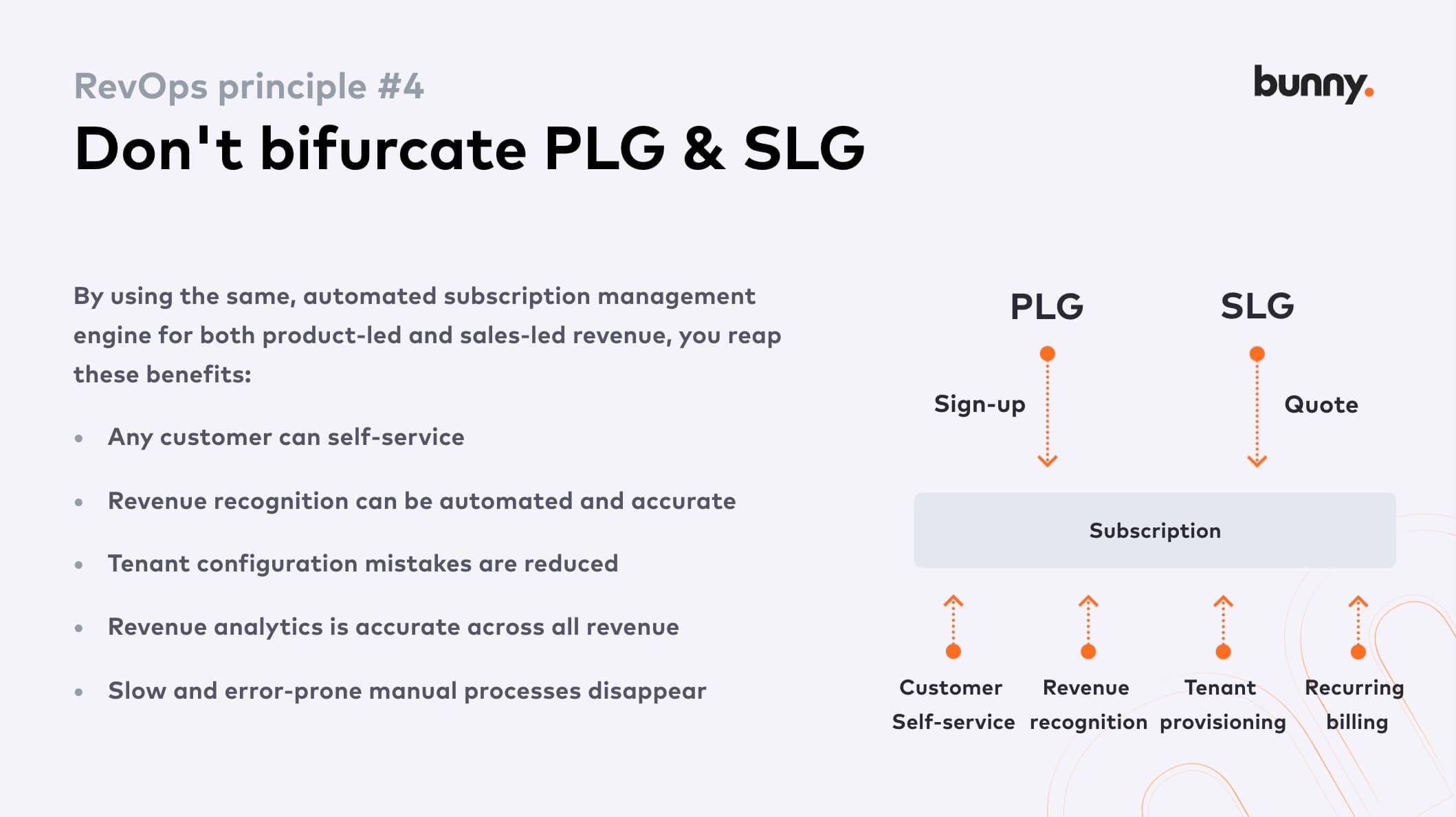

Bunny RevOps principle #4 - Don't bifurcate PLG & SLG

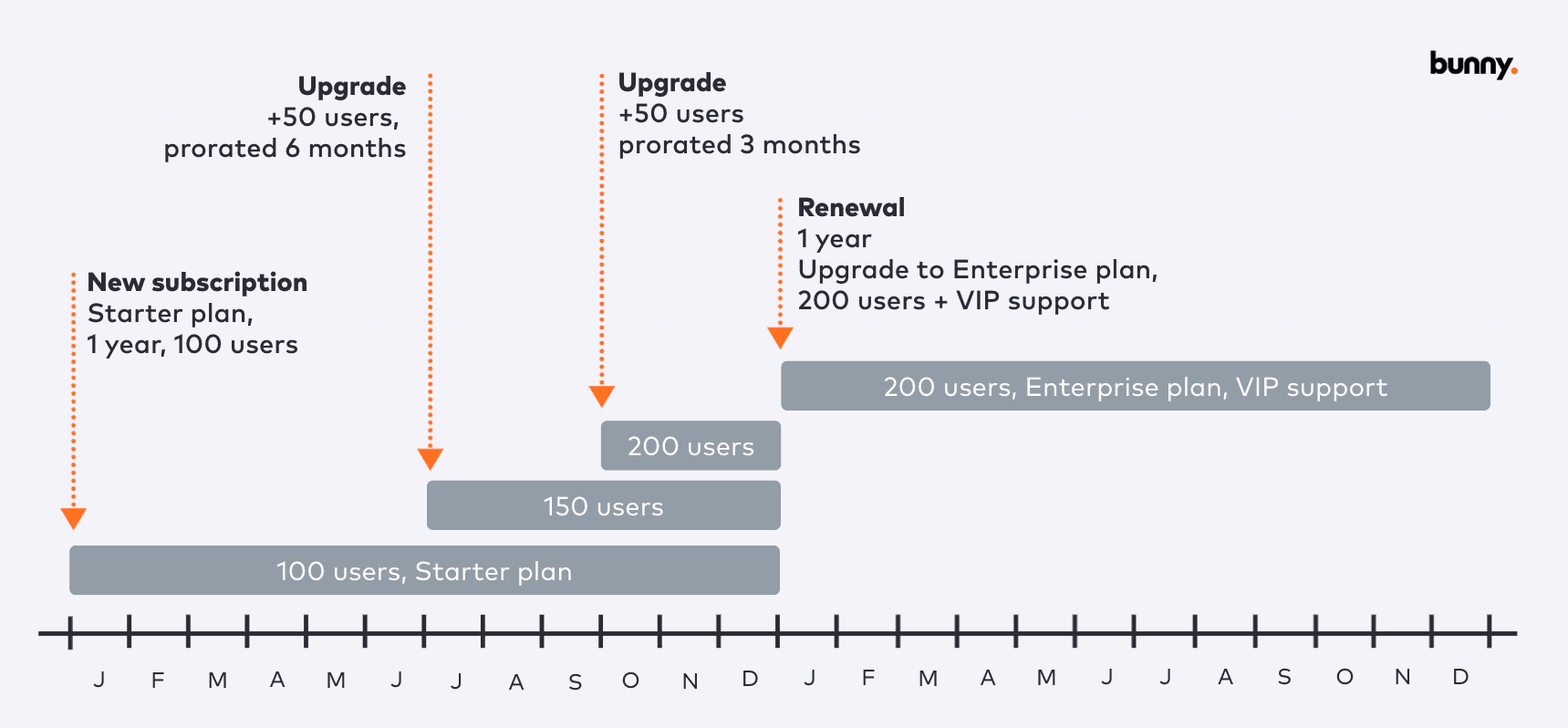

The billing journey for many B2B SaaS companies goes like this.

The product is launched with an integration to Stripe. Customers sign up on the website, puts in their credit card and get billed every month. Pretty simple so far.

As the product gains traction, deals gradually grow larger, which means customers want discounts. Anyone who is willing to pay $50-100k a year has some negotiation power. When the first large deal is closed, the billing infrastructure in place is unable to handle the non-standard pricing and the customer’s desired payment method. This means that accounting will have to invoice the customer from QuickBooks or similar and handle the incoming payment manually.

Now your PLG and SLG revenue streams have become bifurcated. From here on, manual processes are required for reconciliation, dunning, renewals, price changes, revenue recognition etc. And the invoiced customers don’t have self-service capabilities because pricing is non-standard and activation is handled manually by someone in accounting.

You have shot yourself in the foot. The sooner you reel in this two-headed monster, the better you will be off. Most likely, sales-led revenue will outgrow self-service revenue and at some point, the transaction volume for existing customers will outgrow that of new customers. But now everything is manual and leaves behind a massive paper trail of upgrades and renewals that is very expensive to manage.

Don’t bifurcate. Or fix it early.