What are the top 5 saas metrics for 2023?

The last 12 months have been a roller coaster ride for the global economy with many countries teetering on the brink of recession. The effects of this ride have been especially nauseating for B2B SaaS companies, many of whom have seen decreases in new revenue, churn and as a result had to cut costs and decrease headcount.

So how can B2B SaaS companies manage their way through these uncertain times and be positioned for growth again when the markets regain momentum?

Look at the patterns of the past. Anyone who ran a SaaS company through the GFC and following years experienced times very similar to conditions we have right now. Success will be found in keeping things simple and sticking to the basics. Trying to maintain positive revenue growth and reducing costs where possible.

Eventually the economy will strengthen again and by monitoring these 5 bread and butter SaaS metrics your SaaS company will not only weather the storm but also be positioned for the next growth cycle.

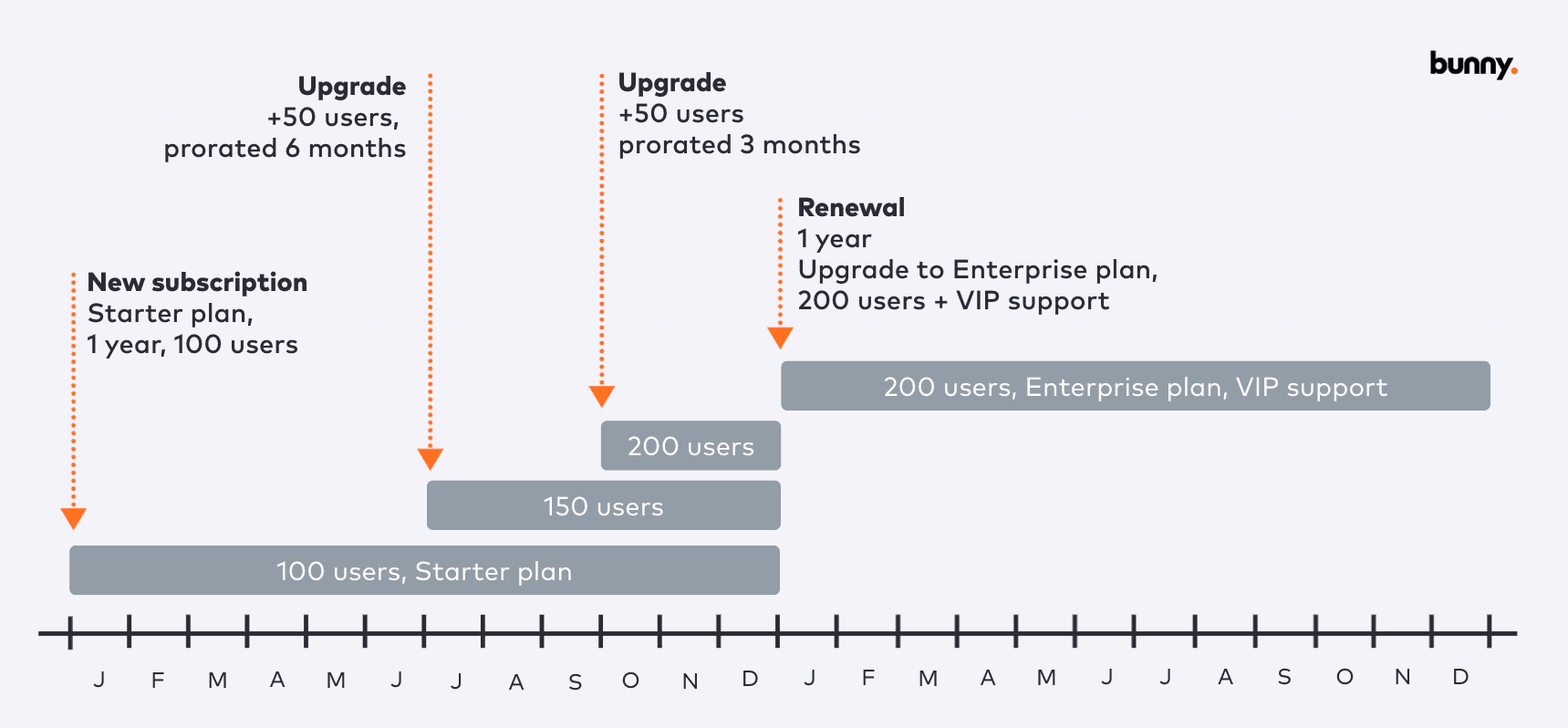

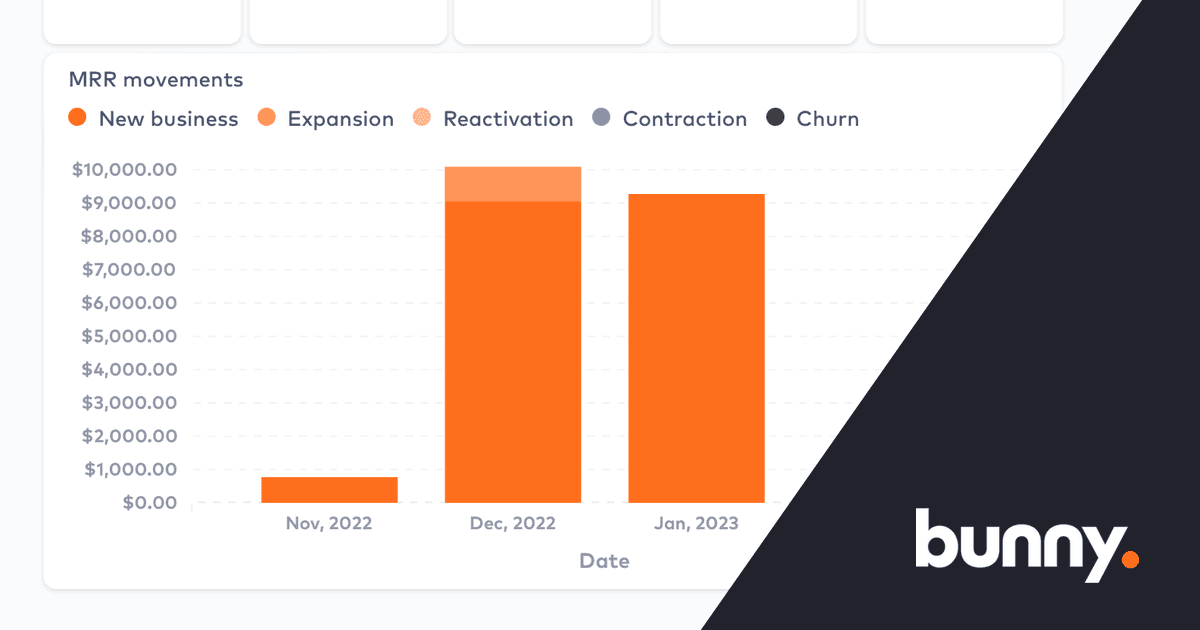

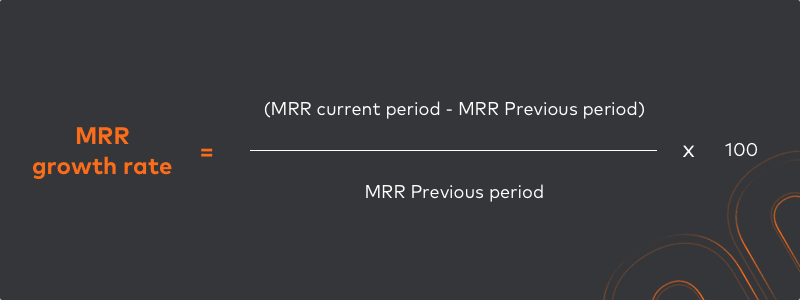

1. Monthly Recurring Revenue (MRR) Growth Rate

MRR growth rate is the percentage change in MRR from one period to the next.

The MRR growth rate is important because it helps you understand how much revenue is being generated each month and whether this amount is increasing or decreasing. A positive growth rate indicates that the company is still acquiring new customers or expanding the business, while a negative growth rate indicates that the company is losing customers or experiencing slower growth.

2. Customer Acquisition Cost (CAC)

CAC is the total cost of acquiring a new customer, including all marketing and sales expenses.

CAC is useful because it helps you understand how much money the company is spending to acquire new customers and whether this cost is justified. High CAC can be a red flag during, as it indicates that the company is spending too much money on acquiring new customers, which can lead to negative cash flow.

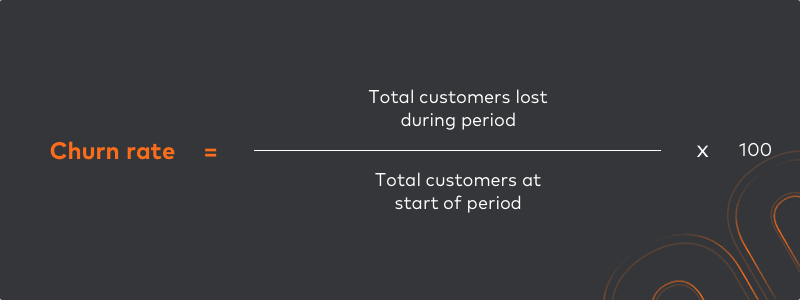

3. Churn Rate

Churn rate is the percentage of customers that cancel or do not renew their subscriptions in a given period.

Watching churn rate helps you understand how much revenue is being lost each month and whether this amount is increasing or decreasing. A high churn rate can indicate that customers are canceling their subscriptions due to economic hardship or dissatisfaction with the product, while a low churn rate can be a sign of customer loyalty and satisfaction.

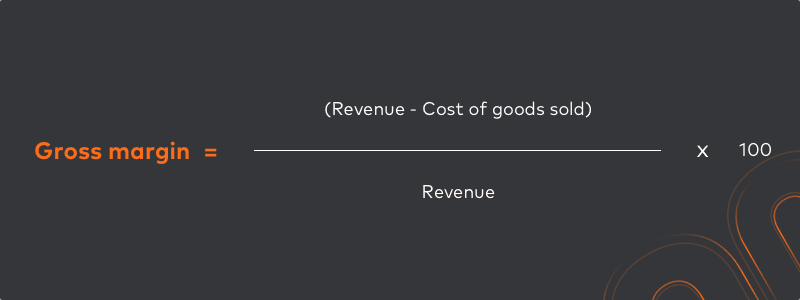

4. Gross Margins

Gross margins are the difference between revenue and the cost of goods sold, expressed as a percentage.

Gross margins help you understand whether the company is generating enough revenue to cover its costs and make a profit. High gross margins indicate that the company is operating efficiently and profitably, while low gross margins can indicate that the company needs to reduce costs or increase prices to maintain profitability.

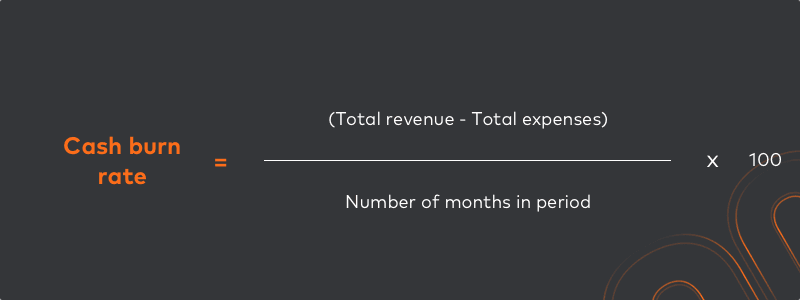

5. Cash Burn Rate

Cash burn rate is the rate at which a company is using up its cash reserves to cover its expenses.

Monitoring the cash burn rate lets you understand how quickly the company is burning through its cash reserves and whether it has enough cash to survive the downturn. A high cash burn rate can indicate that the company is at risk of running out of cash, while a low cash burn rate can indicate that the company is managing its cash flow effectively.

So there you have it, in summary the trick is to watch expenses, cash burn and margins, keep customers happy with a great product and pull out all the stops to maintain positive MRR growth. By keeping these metrics in check you will be well placed to grow when the storm subsides.